- AFFORDABLE TRUST AND

WILL SERVICES

- FAST, EASY FORMS

PLAN YOUR ESTATE AT HOME

- PROTECT YOUR

BENEFICIARIES

Best Online Estate Planning Site in the USA!

Instructions

Important Information about USA Estate Plan!

These forms are meant to assist the millions of Americans who want cost efficient estate planning in a simple estate.

- USA Estate Plan can be used in all 50 states.

- USA Estate Plan provides a Living Trust and Will for only $59 for Single people and $79 for Married couples.

- USA Estate Plan is appropriate for:

- (1) Married Couples with children who wish to leave their assets first to the surviving spouse, and then equally to their children at an age which you can decide;

- (2) A Single Person with children who wishes to leave assets equally to the children at an age which you can decide;

- (3) Married Couples without children who wish to leave their assets first to the surviving spouse, and then however you decide; or

- (4) A Single Person without children who wishes to leave assets however you decide.

Complete your Questionnaire, Receive your Documents via email, then just follow these THREE EASY STEPS.

-

Step 1: Sign Your Living Trust & Will

LIVING TRUST

The Living Trust should be signed in the presence of a Notary Public. The Notary should attach the proper Notary form for your state to the Trust. The Notary must be present on the date written on your Trust. For example, The John Doe Living Trust Dated January 15, 20xx should be signed in the presence of a Notary Public on January 15, 20xx.

Here’s an example for a Married Couple:

Settlor:

NAME OF HUSBAND

Settlor:

NAME OF WIFE

Trustee:

NAME OF HUSBAND

Trustee:

NAME OF WIFE

WILL

Sign your Will on the same day that you sign your Living Trust. You need to sign your Will in the presence of two (2) different witnesses. The witnesses must be over the age of 18 and they cannot be related to you by blood or marriage.

After you sign your Will, then each of the two independent witnesses should sign their name above the line, print their name below the line, and write in their address.

Here’s an example:

Witness #1:

Signature:

Print Name:

Residing at:

Witness #2:

Signature:

Print Name:

Residing at:

Now that your Living Trust is created, you must “fund it” ie. transfer your assets into it (See Step 2)

Guardian

If you have a minor (under age 18) child, the Nomination of Guardian form should be signed in the presence of a Notary Public. The Notary should attach the proper Notary form for your state to the Nomination of Guardian. -

Step 2: Transfer Assets Into Your Trust

Transfer Assets Into Your Trust

Exceptions to Probate

Transfer Your Assets into Your Living Trust

Once you set up your Living Trust, look at it as a “bucket” which you need to fill up with your assets. You do not want an “empty bucket.” If you leave an asset outside your Living Trust, then that asset may have to go through Probate ie. the Court System (unless it is one of the Exceptions to Probate – see below).

After you have set up your Living Trust, one by one transfer your assets into your Living Trust by changing the name on the document of title. It takes time to get all your assets titled into your Living Trust so just make a list of all your assets and one by one transfer them into your Living Trust by following the instructions below.

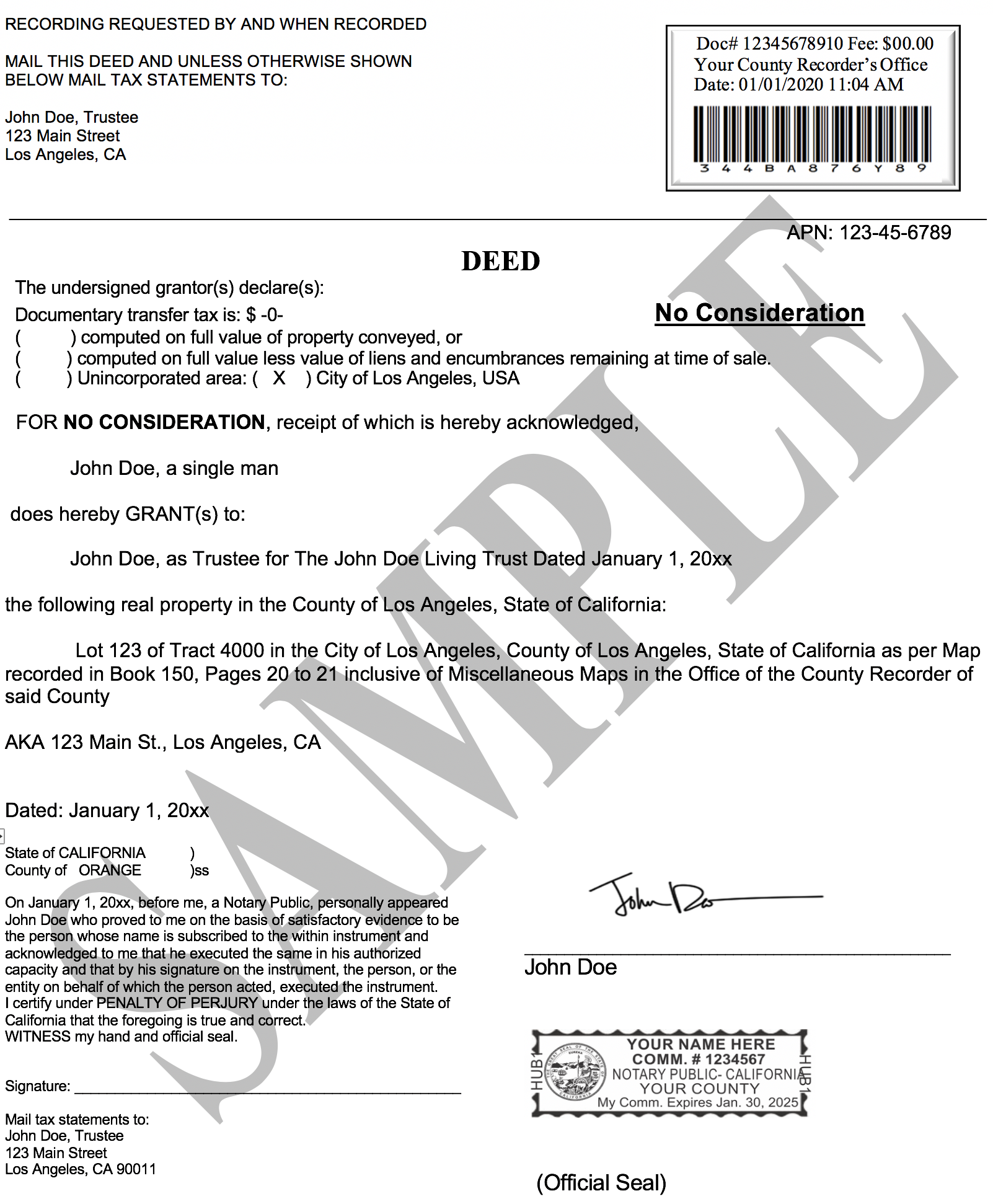

Real Estate

It is important that you complete and record in your local County Recorder’s Office a Deed to transfer your real estate into your Trust. This is part of “filling up your bucket”.

Each State has a different Deed so you need to obtain the correct Deed form for your State. Please see your local Realtor and obtain the correct Deed transferring your real estate into your Living Trust.

Steps:Here is an example Deed:

- Obtain and complete the proper Deed for your State to transfer your real estate into your Living Trust – see your local Realtor;

- Sign the Deed in the presence of a Notary Public;

- Record the Deed in your local County Recorder’s Office.

Title to your real property in the trust should read:

“John Doe, as Trustee for The John Doe Living Trust Dated January 15, 20xx”,

or

“John Doe and Jane Doe, as Trustees for The John Doe and Jane Doe Living Trust Dated January 15, 20xx”.

Bank Accounts

Go to your bank and simply tell them that you have set up a Living Trust and want to transfer your account into your Living Trust. They will likely ask for a copy of your Trust so bring one with you. The bank will change the name on your account from your name individually (“John Doe”) to your name as trustee of your trust (“John Doe, Trustee of the John Doe Living Trust”). The specific language that your bank may use to transfer your bank account into your Living Trust may vary from bank to bank.

Stock Accounts

Go to your stock broker and simply tell them that you have set up a Living Trust and want to transfer your account into your Living Trust. They will likely ask for a copy of your Trust so bring one with you. The stock broker will change the name on your account from your name individually (“John Doe”) to your name as trustee of your trust (“John Doe, Trustee of the John Doe Living Trust”). The specific language that your stock broker may use to transfer your stock account into your Living Trust may vary from stock broker to stock broker.

Department of Motor Vehicles

Go to your local DMV and simply tell them that you have set up a Living Trust and want to transfer your vehicle title into your Living Trust. They will likely ask for a copy of your Trust so bring one with you. The DMV will change the name on your vehicle registration from your name individually (“John Doe”) to your name as trustee of your trust (“John Doe, Trustee of the John Doe Living Trust”). The specific language that your DMV may use to transfer your vehicles into your Living Trust may vary from DMV to DMV.

Other Assets

Except for the assets which transfer outside of Probate (see section below for Exceptions to Probate, which generally are assets held in: (1) Retirement Plans, (2) Life Insurance and (3) Joint Tenancy), it’s important that you transfer all your assets into your Living Trust (your “bucket”). Generally, you want to go to the holder of the document of title and just tell them that you have set up a Living Trust and want to transfer title of your asset into your Living Trust. Each place will have their own procedures so simply follow what the asset holder tells you to do.

For example, if you own a bank account, you go to the bank and tell them you’ve set up a Living Trust and want to transfer title of your bank account into your Living Trust. The same applies for a stock account. Simply go to your stock broker and tell them you’ve set up a Living Trust and want to transfer title of your stock account into your Living Trust, etc. The same concept applies for all your other assets.

Remember, as you acquire new assets to add them to your Living Trust as well – fill up the bucket!

Exceptions to Probate

There are some types of assets which are not put in your Living Trust and still avoid Probate. However, keep in mind that these assets, although they avoid Probate without being in your Living Trust, are still part of your estate and must be addressed in your estate plan.

In general, the following assets avoid Probate:

* Retirement Plans;

* Life Insurance; and

* Assets held as Joint Tenants

Retirement Plans

For all your retirement plans, please contact your financial advisor, company, bank or other administrator of the plan for the necessary forms and procedure to direct the funds to the proper designated beneficiary.

Retirement Plans, such as an IRA, SEP or a 401(k), have a “Beneficiary Designation” form, which you are generally required to complete upon setting up your Retirement Plan. Ask your Plan Administrator for a copy of your Beneficiary Designation form. Generally, upon your passing, the Plan Administrator will distribute without Probate your Retirement Plan pursuant to your Beneficiary Designation form. This is because you have a contract with your Plan Administrator which essentially says that “upon my passing, give my money to my designated beneficiaries”.

Do not leave your Beneficiary Designation form blank, because that asset will then go through Probate. You should provide a copy of the Living Trust to your financial advisor, company, bank or other administrator of the plan, and also discuss the distribution options, including their tax implications, with them before deciding on your beneficiary designations.

Because the terms of retirement plans vary, you should rely only upon the advice of your financial advisor, company, bank or other administrator in determining the tax and other treatment of your retirement plan.

Be sure to follow-up with your financial advisor, company, bank or other administrator of the plan which administers your retirement plan to complete a new Beneficiary Designation form.

Life Insurance

The same principle applies to Life Insurance as to Retirement Plans. Life Insurance contracts have a “Beneficiary Designation” form which you are generally required to complete upon setting up your Life Insurance. Ask your Life Insurance Company for a copy of your Beneficiary Designation form. Generally, upon your passing, the Life Insurance Company will distribute without Probate the proceeds of your Life Insurance pursuant to your Beneficiary Designation form. This is because you have a contract with your Life Insurance Company which says essentially that “upon my passing, give my money to my designated beneficiaries”.

Do not leave your Beneficiary Designation form blank, because that asset will then go through Probate.

Be sure to follow-up with your insurance agent or the company who issued your Life Insurance to complete a new Beneficiary Designation form.

Joint Tenants

Assets, which are held as Joint Tenants, such as bank accounts, real estate, etc., are generally not subject to Probate, but instead pass by operation of law automatically to the surviving named joint tenants.

For example, John Doe and Jane Doe have a bank account titled “John Doe and Jane Doe as Joint Tenants”, and John Doe passes away. Jane Doe immediately, without Probate, becomes the sole owner of the bank account as the surviving joint tenant.

Note that even if you have a Living Trust, the assets held in Joint Tenancy will go to the surviving joint tenants regardless of what the Living Trust says. Joint Tenancy avoids Probate, but it also avoids the Living Trust.

Therefore, if you want an asset to go to the beneficiaries named in your Living Trust, then you need to title the asset in the name of your Living Trust, and not as a Joint Tenant. Often couples will hold title as Joint Tenants thinking one or the other will survive. However, upon the passing of both people, then the asset held as Joint Tenants has to go through Probate, so generally it is better to hold all your assets (except for Retirement Plans and Life Insurance) in your Living Trust. -

Step 3: Operation of Your Living Trust

Congratulations! Once you have created and funded your Living Trust, just continue to manage your assets as you always have.

1. Control of Your Assets

As Trustee you have complete control over all the assets in your Living Trust. Remember, your Living Trust is an Estate Planning document, and as such, it directs your assets upon your passing. During your lifetime, you still have full ownership and control of all your assets.

2. Tax Returns

Your accountant will be able to advise and help you with the filing of the appropriate tax returns for the Living Trust, but in general, here is what occurs:

Single - All of the assets in your Living Trust are held in accounts using your social security number so you continue to file your normal federal (Form 1040) and state income tax returns just as you did before setting up your Living Trust.

Married – While both spouses are alive, all of the assets in your Living Trust are held in accounts using either husband or wife’s social security number so you continue to file your normal federal (Form 1040) and state income tax returns just as you did before setting up your Living Trust. After the passing of one spouse, the social security number on all of the assets in your Living Trust should be changed to be the surviving spouse’s social security number, and the surviving spouse will continue to file his or her normal federal (Form 1040) and state income tax returns just as you did before setting up your Living Trust.

Again, your accountant will be able to advise and help you with the filing of the appropriate tax returns for the Living Trust.

3. Changes to Your Living Trust

As Settlor (creator of the Living Trust), you can revoke or amend your Living Trust any time you want.

If you change your mind about who you want your beneficiaries to be, or the terms of the distribution to those beneficiaries, such as the age of distribution, or if you want to just revoke your entire Living Trust, you have the right to do so.

You can change your Living Trust by either:

(1) creating a new Living Trust on USA Estate Plan or otherwise and transferring your assets into the new Trust, or (2) by executing a revocation or amendment which should comply with all the local laws of your state for which you should seek the advice of a qualified attorney in your state.